The retirement savers credit is a tax credit available to taxpayers who put money into a retirement account and whose income is below the threshold for qualifying for the credit.

For 2019 returns, the thresholds are: $64,000 for married filing jointly; $48,000 for head of household; and $32,000 for single or married filing separately (and also qualifying widow[er]). Because of these income restrictions, a lot of people don’t qualify for the credit. But it’s there and if it works it works.

You calculate the credit on Form 8880.

What I want to talk about today is how prior-year withdrawals from a retirement account count against you when calculating the credit.

Prior Withdrawals

Withdrawals taken within the last 3 tax years count against you when calculating the credit. For 2019 returns, that means withdrawals in 2016, 2017 or 2018.

Here’s an example:

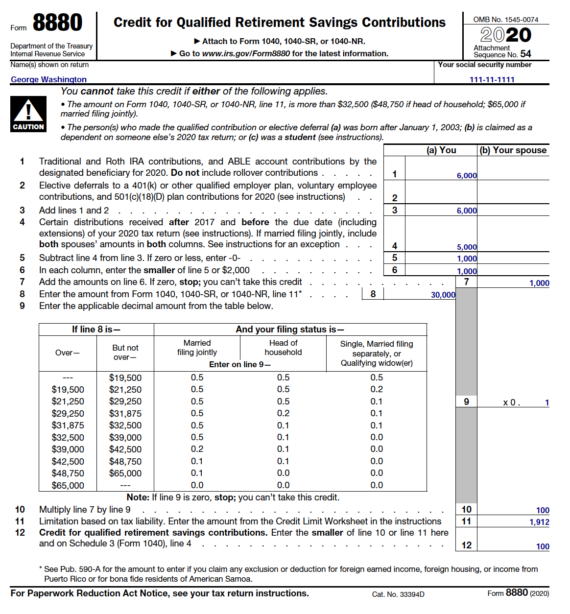

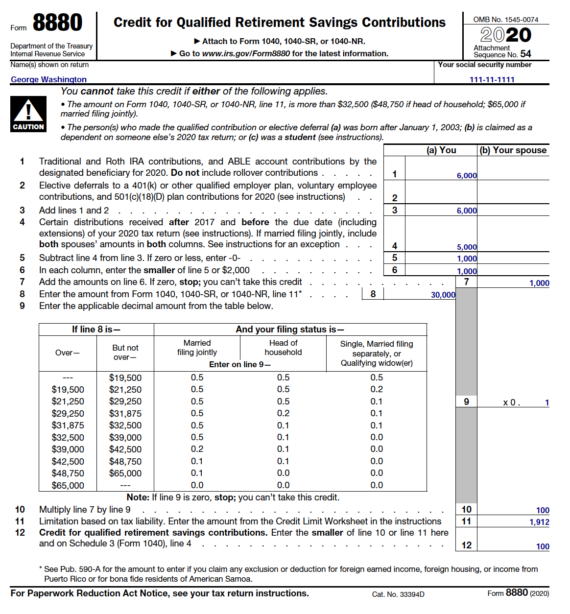

Let’s say George made $6,000 of IRA contributions in 2020. Let’s say he took a $5,000 withdrawal from his IRA in 2018. Let’s say his AGI is $30,000. Let’s say he has nothing else going on, and so will claim a $12,400 standard deduction and nothing else.

Let’s calculate his tax liability first. $30,000 AGI minus $12,400 standard deduction = $17,600 taxable income. The tax for a single person on $17,600 of taxable income is $1,912. Here’s what his Form 8880 will look like:

So here, George’s $5,000 distribution in a prior year prevents him from taking the maximum amount of credit. The maximum credit is based on $2,000 of contributions, but George’s prior-year withdrawal lowers the credit base to $1,000.

Spouse Withdrawals

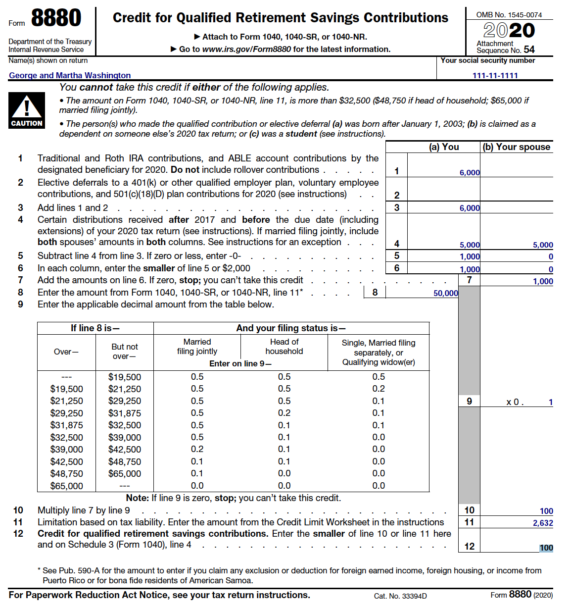

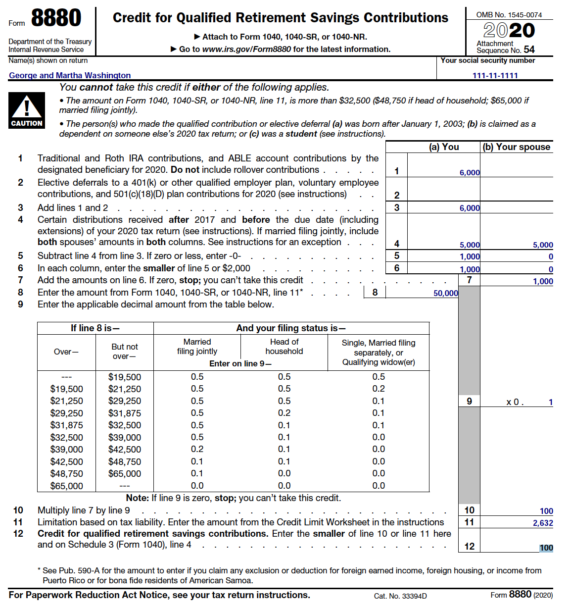

Let’s say George is married to Martha. Their combined AGI is $50,000. George makes $6,000 of IRA contributions and Martha makes no contributions. Let’s change the example here to say George didn’t take a prior-year distributions but Martha did, and let’s say her distribution was $5,000.

First let’s quickly calculate their tax: $50,000 AGI minus $24,800 standard deduction = $25,200 taxable income. Tax = $2,632.

Notice how George gets dinged by Martha’s withdrawal, thus reducing the amount of credit they can claim.