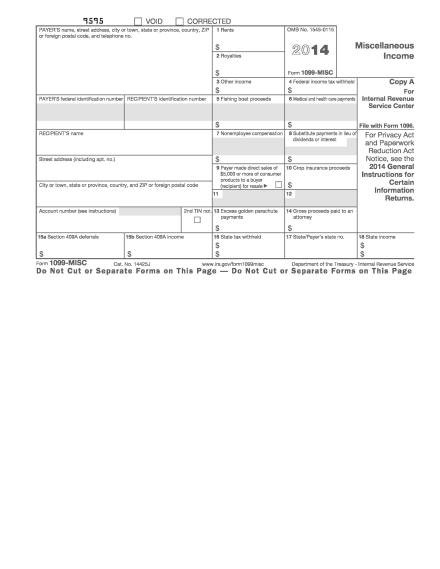

My blog post in January about issuing 1099s to incorporated veterinarians has become one of the most popular posts I’ve ever  written. It’s generated phone calls, e-mails and questions. The most-common question is: when do we need to start issuing 1099s to incorporated veterinarians? When does this rule start?

written. It’s generated phone calls, e-mails and questions. The most-common question is: when do we need to start issuing 1099s to incorporated veterinarians? When does this rule start?

The answer is: there’s not a “start date” to this rule. The IRS’s guidance was in a letter ruling that simply said “yes, 1099s should be issued to incorporated veterinarians.”

In other words, the IRS says it’s how things have always been.

Which brings up a question of: what about prior years? I suppose the IRS would say the technical answer is to file the 1099s late. That seems like crazy talk to me. I would lean towards starting to issue the 1099s from the time of the IRS ruling (December 2013) and forward.