In my last post I wrote about how to interpret the Iowa Form 8453, and how the math on it won’t tie out. The Iowa Form 8453 is the e-file authorization form a tax pro must get a taxpayer to sign, so the tax pro can e-file the taxpayer’s tax return. Now look at the federal version of this form — the Form 8879.

The federal Form 8879 is easier to understand that the Iowa Form 8453. Often — but not always — you can perform math on the form and it will tie out to the tax return. As with the Iowa Form 8879, it’s best if we start with the tax return. We’re using 2020 numbers here for the standard deduction and tax tables.

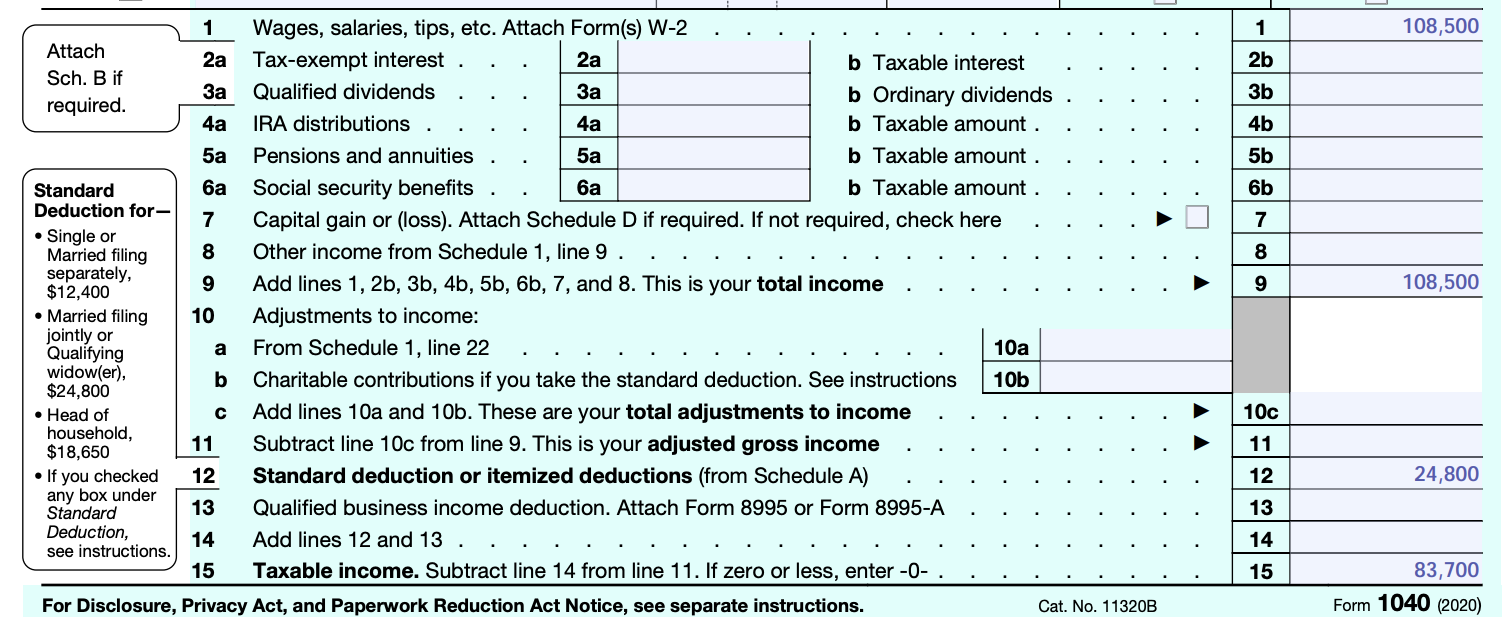

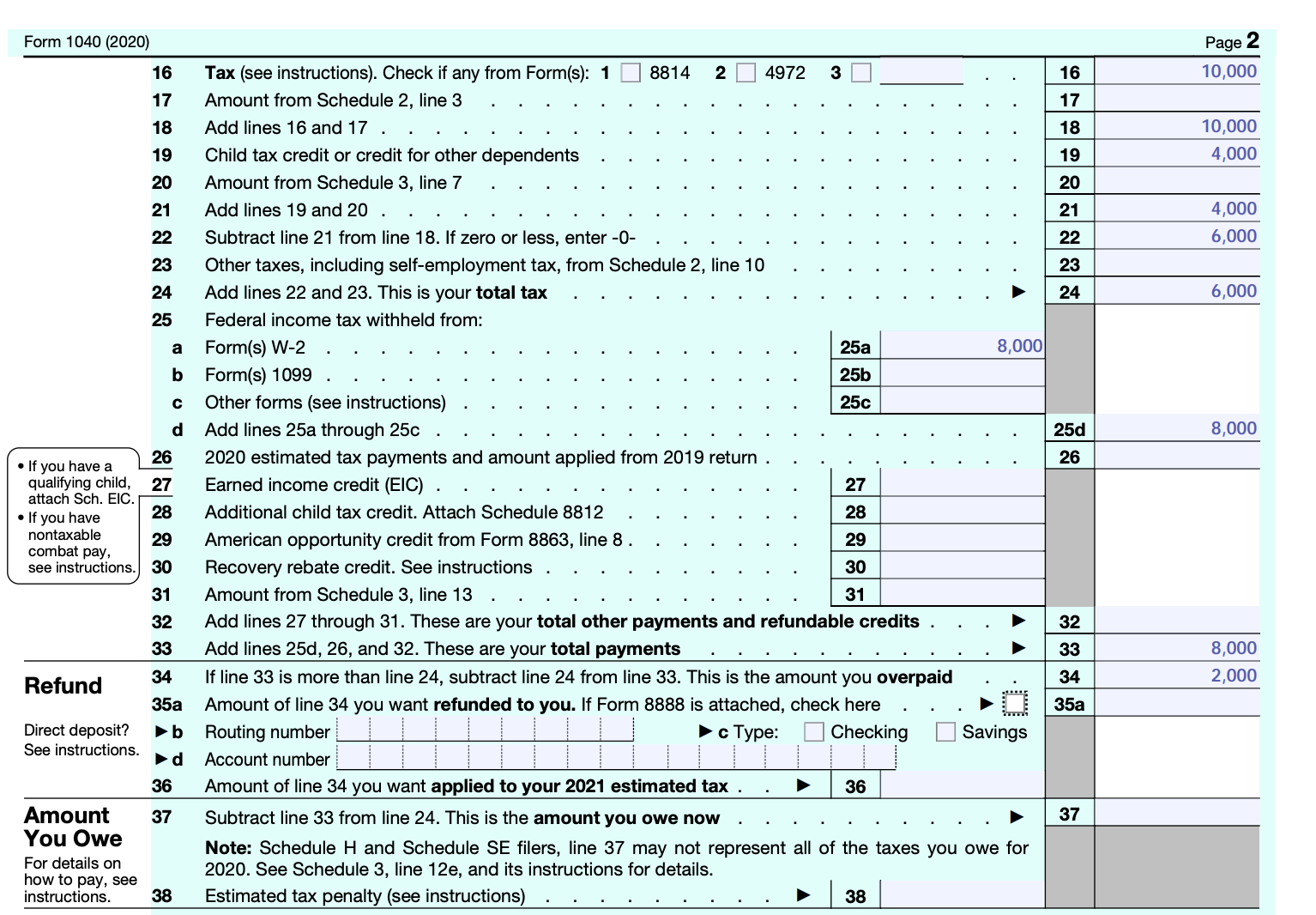

In our example, the taxpayer has a tax liability of $10,000. They have 2 kids, so $4,000 in child tax credits (using 2020 as the tax year), and had $8,000 withheld in taxes. This produces a $2,000 refund.

In our example, the taxpayer has a tax liability of $10,000. They have 2 kids, so $4,000 in child tax credits (using 2020 as the tax year), and had $8,000 withheld in taxes. This produces a $2,000 refund.

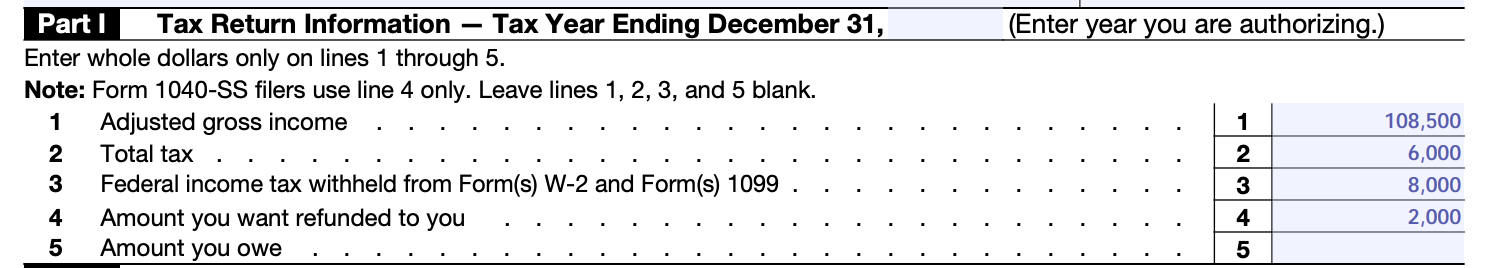

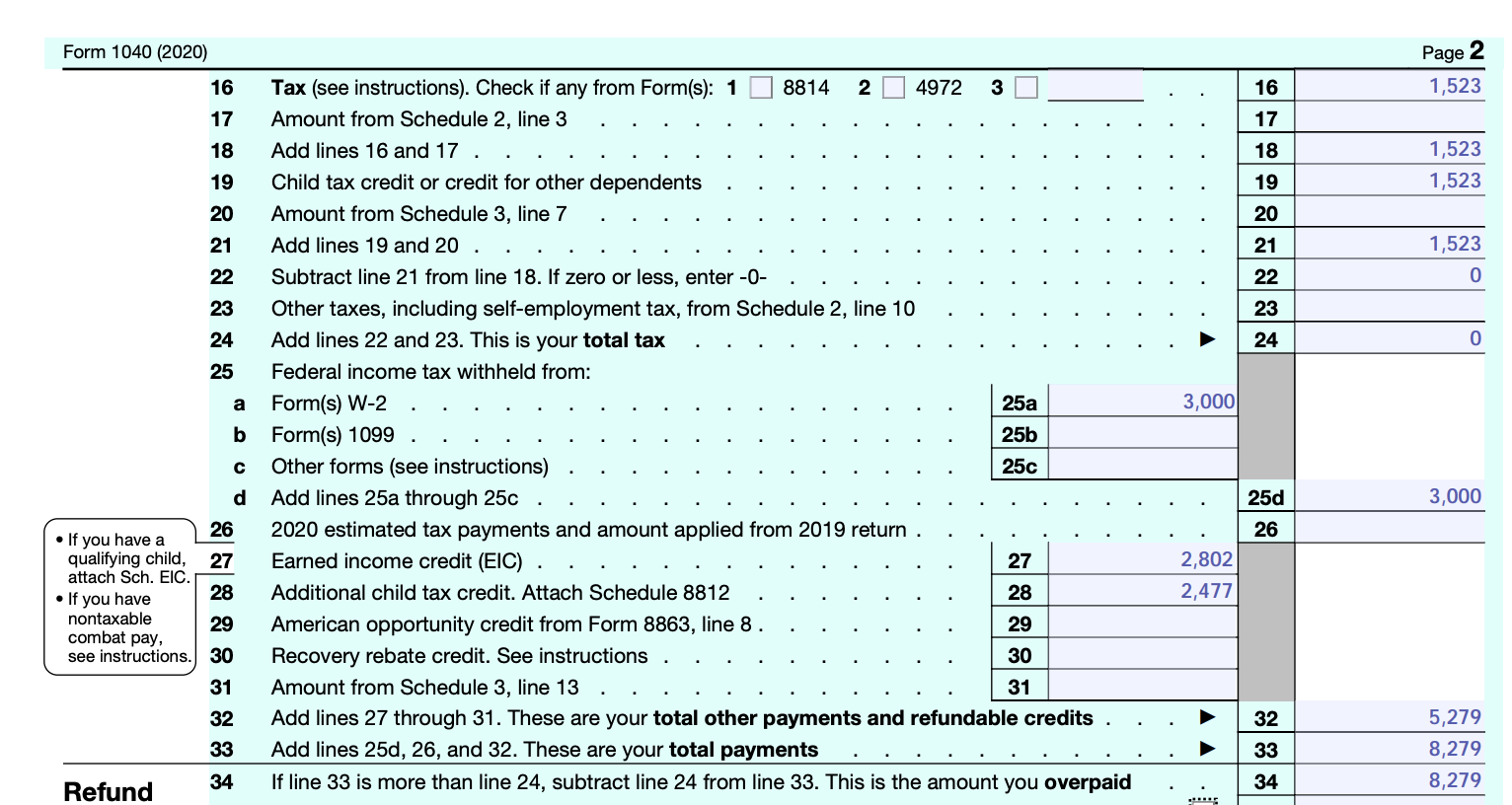

Here’s what their Form 8879 looks like:

The nice thing about the federal Form 8879 is that it will often tie out to the tax return. Taking line 2 minus line 3 will yield the same refund amount as shown on the return — unless refundable tax credits are involved.

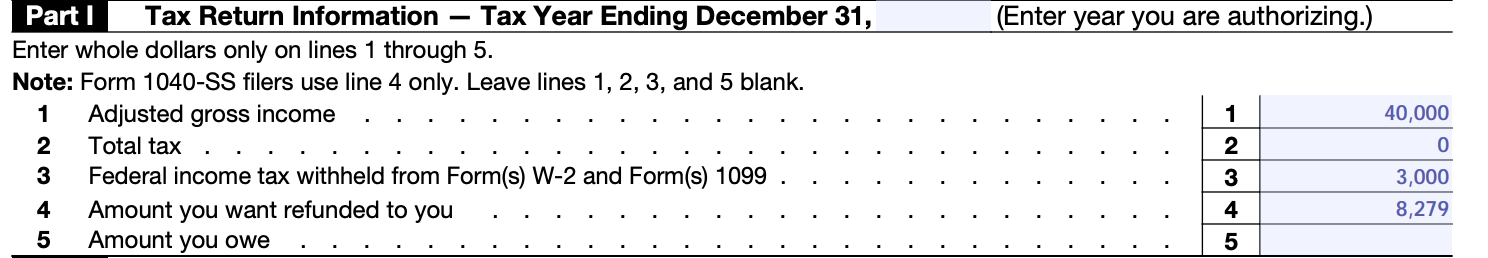

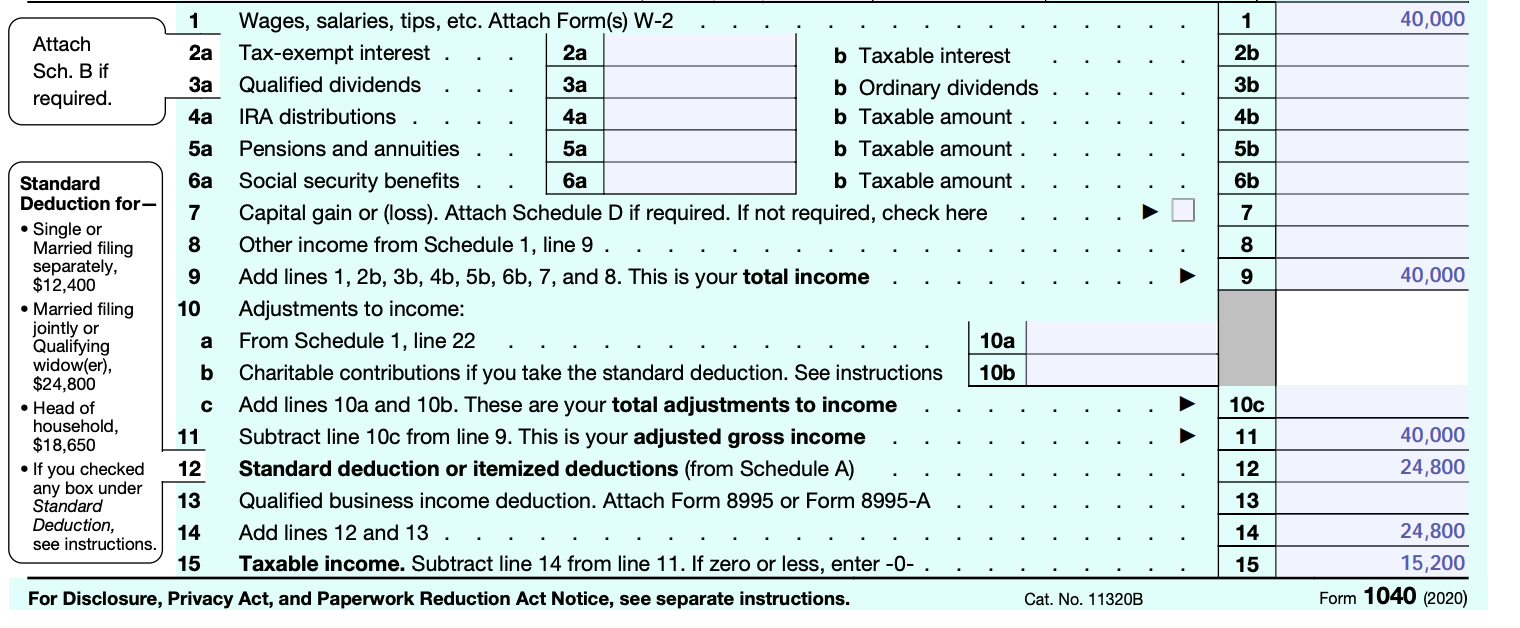

Let’s say this married couple with 2 kids has income of $40,000 in total. Then their return looks like this:

Here, there are refundable tax credits — $2,802 of earned income credit and $2,477 of additional child tax credit. Those refundable credits are not included on the Form 8879, so you won’t be able to get the math to work out just by using the form: