NOTE: I wrote this post in 2012, so be aware of its age. All these years later this is still a hot topic. The short answer is: no, don’t issue a 1099-C to a deadbeat customer.

—–

UPDATE: The IRS addresses this issue in more detail in guidance released February 5, 2015. Click here for my updated take.

—–

I’ve recently undertaken a bit of a research project with my friend Bruce McFarland, The Missouri Tax Guy. Bruce has a few clients who haven’t paid him (ironically, and perhaps a bit humorously, the deadbeat clients are CPAs!). Bruce was wondering if it would be okay to issue a Form 1099-C to the deadbeats.

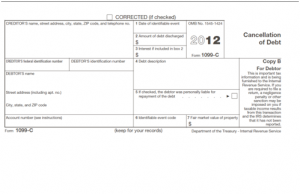

Form 1099-C is issued when debt is canceled. The instructions to the 1099-C, and the code and regulations, only say that financial institutions and other businesses that are in the “business of lending money” are required to report canceled debt.

So unless your business is in the business of lending money, you aren’t required to issue a 1099-C to a non-paying client.

But are you prohibited from doing so? It doesn’t appear so, at least not under tax law.

In IRS SCA 1998-020, the IRS tackles this subject and seems to conclude that it’s acceptable for businesses to issue a 1099-C to a non-paying client, even though such reporting is not required.

One thing the IRS memo points out is that even though it’s okay under tax law to issue a 1099-C to a deadbeat client, it might not be okay under other laws, such as laws relating to collection of debt. Since I’m not an attorney, I won’t go into that area.

Within tax law, it appears to be okay to issue a 1099-C to a deadbeat (or I suppose you could threaten to issue a 1099-C, just to scare them, even if you had no intention of actually doing it).

It’s All Right But It’s Not Okay — Or Should That Be, It’s Okay But It’s Not All Right?

Personally, I wouldn’t issue a 1099-C to a deadbeat client. I realize there may be some satisfaction in threatening a deadbeat and seeing them sweat. But I think it would cause more harm than good to go down the 1099-C route.

For example, in the June edition of the NATP “Tax Pro Monthly,” there was a story about someone getting sued for fraud because they issued a 1099-C to someone who owed them money. A court ruled in favor of the person who issued the 1099-C. That’s the good news. But the case shows that a recipient of a 1099-C is likely to fight and protest and threaten and make your life more difficult. That’s why I say you’d be causing more harm than good by issuing a 1099-C.

I would just fire them, move on with my life and replace the deadbeat with a better client.

Jason, Thanks for you help in this. Without you I think It might have been months before I found the answer I was looking for.

Always glad to help – it was a fun exercise!

[…] client or customer that doesn’t pay you what they owe you? Bruce the Missouri Tax Guy and Jason Dinesen both address that today. Both posts are worth reading. Jason explains: So unless your business […]

Can I issue a 1099-C to an individual for a personal loan that has not been paid ? There is zero chance that I will get anything out of this person. I am not a business, this was just a loan between to friends, or should I say ex-friends. The amount in question is $100,000, so I dont want to just move on. I cant collect, but I would feel better if the other party was taxed on the income.

Thanks,

Michael

Based on the research that Bruce and I did in writing our articles on this, there don’t appear to be any prohibitions against you issuing a 1099-C. I would recommend proceeding with caution, though. As I mentioned in the last paragraph of the article, a recipient of a 1099-C in a case like this is likely to put up a fight. You may want to talk to an attorney to make sure the loan is properly documented.

Thanks. There was no formal loan document as this was a friend, but I have lots of proof that the friend got the money

Mike