Question: I received a K-1 from a partnership I’m invested in. Their fiscal year-end is September 30th.

Question: I received a K-1 from a partnership I’m invested in. Their fiscal year-end is September 30th.

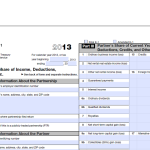

The K-1 for the year ended September 30, 2014 shows that it’s a 2013 K-1. I received the K-1 in 2015. What year do I report this K-1?

Answer: for taxpayers receiving a Form K-1, the information is reported based on the fiscal year-end. In this example, the information would be reported on the taxpayer’s 2014 tax return because the K-1 relates to the year ended September 30, 2014.

The fact that the form says it’s a 2013 form is relevant on the partnership side (the partnership’s tax return for the FYE 9/30/14 is considered a 2013 filing on the partnership side). But this isn’t relevant for the recipient.