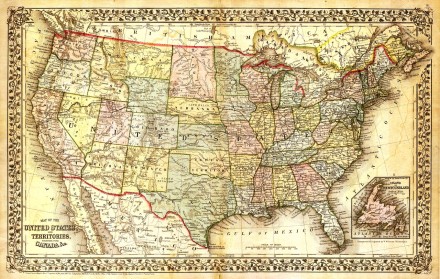

Now let’s shift to talking about operating a business in multiple states. (Note: this presentation is given to Iowa-based business owners and so uses Iowa as the “home state,” but this discussion applies to any business anywhere.)

The biggest question to answer when it comes to operating in other states is to determine if you’re “doing business” in another state.

In general, if you’re “on the ground” in another state providing a service or selling your product, you probably have a business presence in that state. If you’re always in Iowa and never set foot in another state, you probably don’t have a business presence in that state, even if you serve clients in another state or sell products to customers in that state. But it’s a good idea to look up the rules in those other states, just to make sure.

If you do have a business presence in another state, these are the things to be aware of:

- You’ll want to check to see if you need to register to do business in that state. As a very general rule, sole proprietors usually don’t need to register, but corporations usually do. Note my ambiguous usage of the words “very general” and “usually.” In each state where you have a business presence, you’ll want to check on this.

- Review that state’s sales tax laws – you might need to collect sales tax. Different states have different rules on what’s subject to sales tax vs. what’s not. Something might not be subject to sales tax in Iowa but might be subject to sales tax in Minnesota, for example.

- Review that state’s income tax laws – you probably need to file an income tax return in that state

- Review that state’s payroll laws – if you have employees who go to that state to conduct business, you might need to file payroll returns in that state

And remember: states are aggressive at enforcing their tax laws. Don’t assume you can get by with crossing state borders to conduct business and not get caught.